At Harrison Drury, our team of highly experienced, dedicated commercial property solicitors advise both lenders and borrowers on all aspects of secured lending and refinancing in property transactions. Our team act for clearing and private banks, building societies, specialist lenders and a broad range of borrowers including companies, pension schemes and individuals and senior solicitors. Our lender panel appointments also enable us to provide dual representation subject to transaction requirements.

Our specialist team understands the needs of both borrowers and lenders and work collaboratively to suggest innovative lending structures and mechanisms, whilst remaining mindful of the time frames required for the transaction. We have extensive experience dealing with complex transactions and multi-property portfolios.

With the increasingly complex nature of many transactions, our clients benefit from the firm’s broader specialist service teams, including land and property dispute resolution, corporate, construction, insolvency and regulatory.

Our areas of expertise include:

- Commercial and residential acquisitions and disposals;

- Development finance;

- Bridging finance;

- Refinancing;

- Sale and leaseback structures;

- Standard form loan documentation;

- Security enforcement;

- Independent Certifier (IC) Deeds;

- Cross guarantees; and

- Collateral security including debentures and personal guarantees.

Our solicitors are experienced in dealing with secured lending across a range of services including, but not limited to:

- Pubs;

- Restaurants;

- Retail premises;

- Office premises;

- Commercial units;

- Commercial and residential development sites;

- Pharmacies;

- Nurseries;

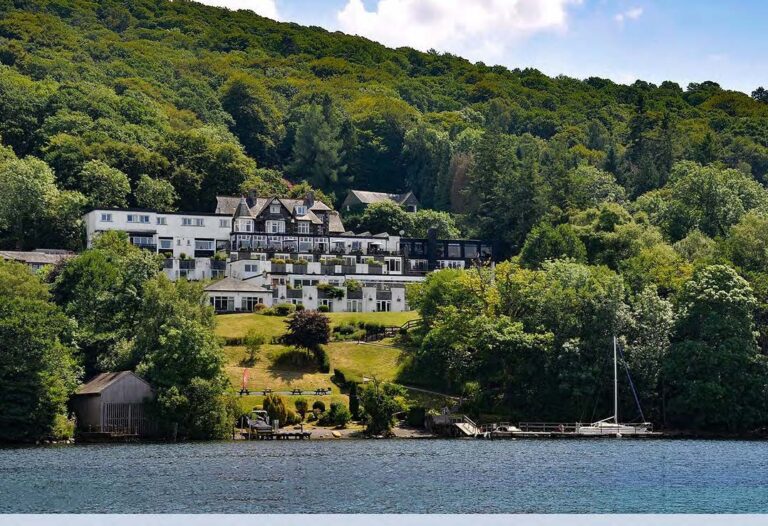

- Hotels and guesthouses.

To speak to our commercial property specialists please call us on 01772 258321 or make an enquiry below to see how we can assist you and your business.